That said, the minimum wage, which is now $19.97 (or $20), is not nearly enough to make ends meet. In fact, it should have been in that region a decade before Kshama Sawant famously led "the Fight for a $15 Minimum Wage." And if you do not care about the general welfare of the largest class of our society (more about this in a moment), there is a sound economic reason to raise the minimum wage higher than $30: it would, in capitalist terms (which is all about growth because only in growth do profits appear), be good for the economy because more workers would be compelled to spend—meaning, return wages to expanded reproduction. The rich, of course, do not really spend that much or even make investments (they buy what British economists, borrowing from the language of French finance, once called placements—investments, as Joan Robinson pointed out, are made by entrepreneurs.)

This fact was even obvious to the father of modern economics (and development economics), the great Adam Smith. As Branko Milanovic explains in his new and excellent book Visions of Inequality: From the French Revolution to the End of the Cold War, Smith defined a prosperous society by its "comeattibleness." Meaning? Because the working class is the largest class, the more prosperous this class of society is, the better (and less barbarous) the society as a whole. Smith: “That state is opulent where the necessaries and conveniencies of life are easily come at … and nothing else can deserve the name of opulence but this comeattibleness.” Case closed.

But Milanovic also points out that Smith had an additional key to general prosperity: low interest rates. Why? Because "low interest [rates have] the advantage of making it difficult for people to live off their wealth without working." Let's now leave Milanovic (but please read his very readable book) and Seattle, and take a quick trip through one of the biggest national stories of 2023: rising interest rates.

The strangest thing happened this year. The Feds raised interest rates from nearly zero to the current 5.25%-5.50%. Fed chief Jerome Powell was hellbent on punishing workers for high inflation. He did not hide this fact. He didn't mince words. He was going to be Volcker 2.0. But then something really unexpected happened. The labor market utterly failed to cool, no matter how rapidly he raised his rates. Indeed, it continued to grow and grow. The US, for example, entered fall (September) with a stunning 336,000 jobs added to the economy. To make matters stranger, inflation, the target of Powell's interest rate hikes, began to fall. How could this be possible? A booming job market, higher and higher interests, and falling inflation?

As far as I can tell, this recent economic development has been, in the Wittgenstein sense, left in silence. But I will not follow the Austrian philosopher into the dark. I have something to say. I have an explanation, which I outlined in several 2023 posts. It still stands.

There is in economics the belief that the stagflation of the 1970s (rising inflation and no growth) was brought to an end by the Volcker Shock of the early '80s. And what did Paul Volcker's high interest rates do? Deflated wages and union power. In this orthodox picture, which had its source in a Keynesian (meaning, center-left economic) theory called the Phillips Curve, prices rose because workers had more cash to spend; and wages rose because there was a high demand for labor. The solution: increase unemployment to stabilize prices (the Phillips Curve trade-off). Volcker (head of the Federal Reserve for Jimmy Carter and Ronald Reagan) did just this. And thus began what former Fed chair Ben Bernanke called the Great Moderation: low inflation (2%), stability, and expansion. This turned out to be a just-so story. And for two reasons made clear by the Fed's 2023 fight against post-pandemic inflation.

One. The interest rate hikes of the 1980s had the appearance (or what in German philosophy is described as schein, which is related to the English word "shine") of being effective because of something Powell and his team missed: What I call "policy alignment." The Fed's rate policy was, under Volker, aligned with the White House austerity policy. The latter worked because the former was, at its core, anti-union, anti-worker. The White House wanted to punish labor power. Align this objective with the famous Volcker Shock and interest rates appear to work, to do their magic.

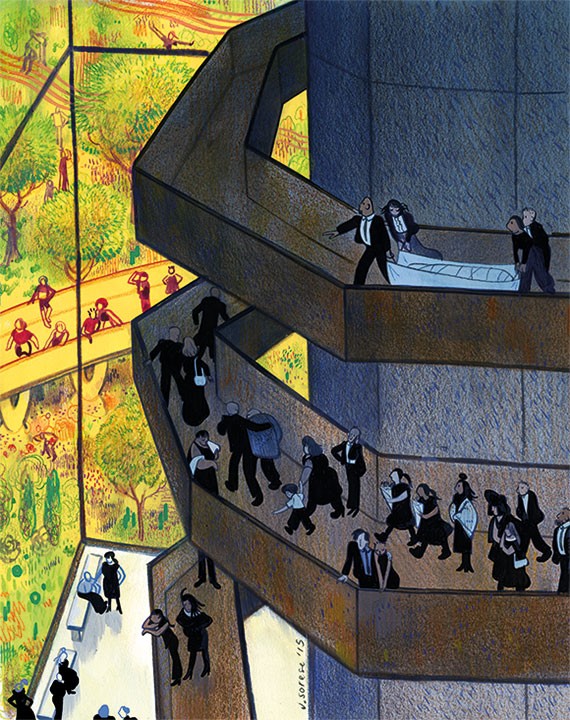

But under Biden, you had a White House not in alignment with the Feds. As the former raised rates, the latter pumped money into the job market. This made the former not only ineffective but even beneficial to American labor. And here we have the second lesson learned from 2023. Inflation began to fall because high interest rates exported it to other and developing economies. The result? Cheaper imports.

Indeed, judging from where the bank crisis of 2023 got its start (Silicon Valley Bank), high interest rates hurt the rich considerably because they collapsed the value of older placements (or paper) with low rates or returns. And so we have today a situation that might shock even Adam Smith. High interest rates are good for US wage earners. Wage earners elsewhere are, of course, not so lucky. They are paying in real (rather than nominal) terms for the cheap products found in Walmart and Target. Biden's US is making out like a bandit because of something no one saw would be an advantage under such conditions (high interest rates); namely a massive current account deficit.

This is how economics really works. Not by the books, which, owing to the Mercantilist obsession with export-led growth, saw current account deficits as nothing but the road to ruin. And even Yanis Varoufakis's The Global Minotaur reinforced this view from a leftist perspective. It was always better to export than import. It was better to beggar your neighbor in exactly this way. It was the golden rule of growth. But such wasn't the case in 2023. We live in very interesting (economic) times.