Whether it was K-12 in north Seattle, classes at Shoreline Community College, or preparing for history seminars at the University of Washington, the idea of a new school year brings to memory excitement and anticipation: books and syllabi, the buzz of campus life, and brain waves set ablaze in cavernous lecture halls.

But for too many parents, students, and teachers, heading back to school means confronting the impact of declining public investment in education: ballooning class sizes, rancorous conflicts with district officials over school closures, and stagnating wages and resources for educators.

The root issue is the class war on our classrooms.

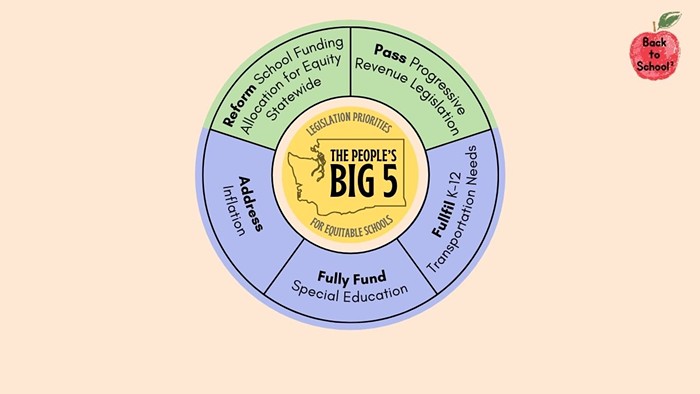

An August 2024 report spearheaded by University of Washington professor and public education expert David Knight identified taxing the rich to fund education as a chief component of a comprehensive plan to "Envision Ample and Equitable School Funding for Every Washington Child." Still, the topic is something like a political third rail in the Washington State Legislature, with even many progressive politicians unwilling to wade into seemingly divisive debates about taxing wealth, to say nothing of the difficulty of figuring out how to distribute resources once they're attained.

The problem of funding public education in Washington is centrally a problem of political courage.

A Concise History of Public Education in Washington

There was a time when the Washington State Legislature made an earnest commitment to fund public education. And at every historical turn, opposition to funding our schools was just as short-sighted as it is today.

When the settlers of Washington Territory proposed a college that became the University of Washington in 1861, the colony’s School Superintendent led the charge against it, absurdly arguing that the state didn't need a college since no student in Washington was yet bright enough to pass a college entry exam: "The expense is too great for the public good. We feel it our duty to protest this hasty expenditure of funds," he said.

At this time, the place that became Seattle amounted to a ramshackle frontier outpost with no paved roads, no hospital, and very few government enterprises besides displacing Indigenous people and keeping the town lumber mill running. Thanks to state leadership, classes at the Territorial University of Washington began anyway in November 1861 on modern day University Street in contemporary downtown Seattle. By the time UW relocated to its current location in 1895, a new fight was afoot to fund public schooling for the people of Washington State.

At the dawn of the Progressive Era during the 1895 Washington Legislative Session, state representatives developed a uniform income for the state's public schools. Championed by Puyallup populist State Rep John Rankin Rogers, the Barefoot Schoolboy Act of 1895 mandated a minimum of $6 of state spending for every child in Washington. This was a revolutionary idea for a state that didn’t have a comprehensive plan for making sure classrooms had what they needed despite a constitution that called funding education Washington's “paramount duty.”

HistoryLink contributor John Caldbick describes how big cities in Washington—Seattle, Tacoma, Spokane—resisted the Barefoot Schoolboy Act because they already taxed their residents to fund schools. Nevertheless, Rankin pressed on, grasping a link between wealth inequality and underfunded schools. Progressivism prevailed: After Washington's first school funding measure passed in 1895 as a tax on large property holdings, the Puyallup politician became popular enough to get elected as governor a year later.

With the foundation of public school funding laid by the Barefoot Schoolboy Act, Washington schools flourished—until they didn’t. Vocational schools sprang up throughout the state, bolstering K-12 education, beginning with the state's first junior college in Everett in 1915 and followed by Centralia College in 1925.

But when the global stock market crashed in 1929, the country sank into a Great Depression, and schools struggled because of declining state funding. Unionized teachers in the Washington Education Association campaigned to get an income tax passed for more resources. Voters approved the measure to save state schools on November 8, 1932; the Washington State Supreme Court deemed the income tax illegal a year later. The court’s rebuke would have negative consequences for education that persist into the present.

After an influx of federal defense spending for World War II ended the Great Depression, Washington politicians once again invested in education. Faced with a flood of returning veterans in need of job retraining, the Washington State Legislature permitted the state's 11 junior colleges to receive funding through their adjacent school districts in 1945. The influx of funds benefited the state’s two-year schools greatly, and in 1967 state reps passed the Community And Technical College Act to shift control of them to the Washington State government. Like plans to create UW and fund K-12 schools before it, the proposal to absorb junior colleges into state control faced friction.

All excuses to not take responsibility for education in Washington tend to have a similar ring to them: petty bickering over money and power, with piddly concerns that seem less and less meaningful the more time passes. In 1967, local officials were reluctant to turn over to the state the revenue garnered from their junior colleges; others feared baselessly that state management would mean downsizing trade and vocational programs. None of it mattered–state electeds showed leadership and made junior colleges the prerogative of the state.

"I know what a furor will be raised when I make this suggestion," said Washington Governor Dan Evans shortly before the passage of the 1967 law that concretized Washington's community college system; "community colleges should be part of [our] higher education.” In 2022, a study ranked Washington’s community college network as the fourth best state-run junior college program in the country.

Looking back on a century of state education funding in Washington from 1861 to 1967, the pattern is clear: State officials defeated myopic resistance to fund education in ways that future generations benefitted from greatly. In almost every example–the 1933 State Supreme Court income tax overrule being the lone exception–the short-term cost of dedicating resources to education was preferable to the long-term cost of inaction.

The history lesson should inform the action we take in the present.

The Current State of Education Funding in Washington (Derogatory)

The recent history of school funding in 'blue' Washington is beset by the durative influence of racial segregation and bad Republican economic ideas.

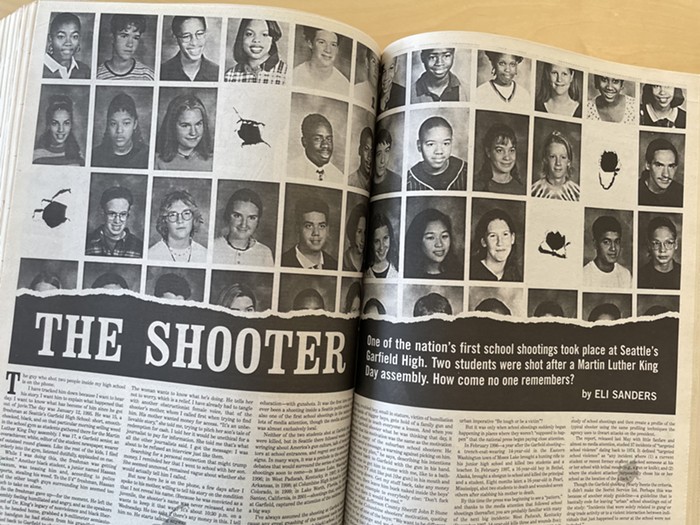

After Washington funded its community colleges in the late 1960s, its K-12 institutions initiated an attempt at racial integration that ended in the 21st century with schools more segregated than ever.

Seattle middle schools began mandatory busing in September 1972, then implemented the program for all its schools in 1978. The contentious “Seattle Plan” briefly succeeded at making the city’s student body more cosmopolitan; but it alienated white parents, who began removing their kids from the K-12 system en masse. The 1996 University of Washington report, “Priority Shift: The Fate of Mandatory Busing for School Segregation in Seattle,” revealed that “the Seattle School District has shrunk by more than half during the past thirty years, mostly due to declining white enrollment.”

Largely a consequence of backlash to integration, charter and private education emerged as serious competitors to public education in Washington State. A steady outflow of students, resources, and esteem for public education began, culminating in a 2007 lawsuit (McCleary vs. State of Washington), where advocates argued that the combination of regressive property tax levies and classist disparities in the state distribution of resources left schools in a state of disrepair. The Washington State GOP stepped up to help the best way it knew how: by making sure no new revenue would be devoted to public education.

After the landmark 2012 Washington State Supreme Court Decision, McCleary v. State of Washington, ruled that the State Legislature was falling short of its constitutional obligation to fully fund schools, Washington's last Republican-controlled State Senate adopted the "Levy Swap" funding model in 2017. A brainchild of Republican gubernatorial candidate Rob McKenna, the mechanism essentially skims a certain amount of a raised statewide property tax for education and then reduces the amount that local districts can raise for themselves via levies; the goal was to create a revenue-neutral funding source where overall property taxes for homeowners would not increase. The “No New Taxes” approach predicated funding for local schools on enrollment, conceding even more power to charter and private schools that were siphoning away students.

In the Republican funding plan, the impact of the 1933 Washington State Supreme Court strikedown of the state income tax felt palpable. With little legal latitude to tax wealth to grant schools resources, state lawmakers had to choose the best of bad options. McKenna’s plan was the only one of four school funding proposals to be straightforwardly dismissed as ‘Not Recommended’ in a 2011 study by the Washington State Office of Financial Management. Observers at the time noted that the GOP-hatched funding mechanism would “erode K-12 funding over time in large districts like Seattle” by undercutting “broad based support for higher taxes to increase school funding.”

By tying state funding to already-declining enrollment and refusing to raise any new revenue, the GOP funding scheme was a seed of austerity grounded in racial divisions. It would grow into a full-on crisis for public education in Washington.

By the end of the 2010s, it was already apparent the Republican funding model had serious flaws: big-city school districts couldn’t tap exploding property values to fund schools because of “Levy Swap” limitations, which wouldn’t grant schools more state funding no matter how rich a city grew. Briefly, an influx of federal COVID-19 relief dollars and the passage of a statewide capital gains tax in 2021 papered over these pitfalls, but the federal funds began to run short. Simultaneously, state spending on schools lost value to inflation. And though the 2021 capital gains tax created a welcome windfall, lawmakers earmarked much of the money for school construction (and not operations), meaning some schools could build new facilities, but many programs in them would crater. The coup de grace for Washington's GOP school funding scheme was COVID-19, which dealt schools a further-deepening enrollment crisis. The school funding house of cards tumbled.

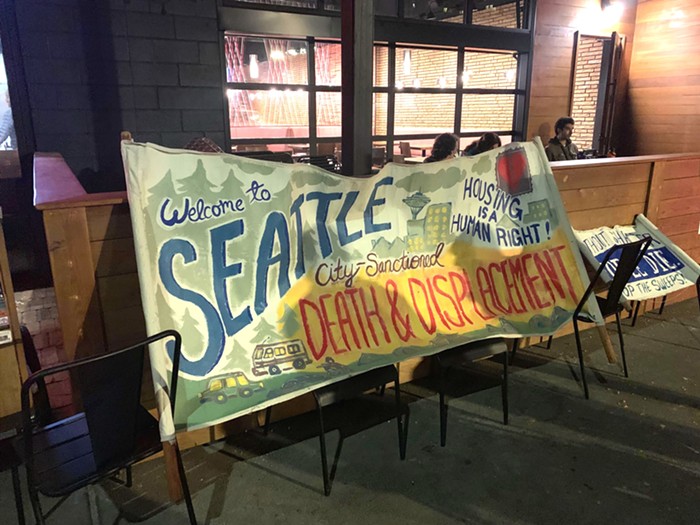

The result of allowing revenue-neutral Republicans to steer education funding is where we are today: the threat of en masse school closures due to under-enrollment; underfunded programs in our schools, ranging from arts education to crossing guards; an unvirtuous cycle of deteriorating services that provokes declining enrollment, which triggers public divestment, which then leads to more deteriorating services, and then more declining enrollment.

On full display in Washington State schools is a quintessential downward spiral of neoliberal institutional decay, where withdrawal of government support from a once-beloved public entity leads to subpar taxpayer experience, which further motivates withdrawal of government support, causing further degraded taxpayer experience. Public education in Washington is being delivered a similar fate as the one befalling the US Postal Service; a textbook example of late capitalist ruin one can read about in libraries suffering reduced hours of operation.

“The problem of a hypercompetitive society organized around the free market is an inhumane political system that allows billionaires to hoard resources,” writes public school teacher Megan Erickson in her 2015 book Class War: The Privatization of Childhood. “This is what must be dismantled, not public education.”

How We Can Fund State Education

In modern-day Washington—where tech titans have amassed fortunes that make the timber moguls of Rep. Rankin's late nineteenth century seem modest—a solution to our school funding woes hides in plain sight. We must tax the rich.

In Olympia, we must devise a short-term solution to prevent school closures, then pivot to constructing a sustainable long-term funding plan that can draw families who have withdrawn their kids from public schools. Trade and vocational education in state community colleges must continue to evolve, while tuition-free access to quality education at the University of Washington must be expanded.

With respect to preventing school closures using progressive revenue: Earlier in 2024, Sydney Brownstone of the Seattle Times unearthed the immense tax breaks enjoyed by corporations that operate data centers in Washington, totaling more than $474 million in deferred taxes since 2018. School consolidations have been pursued in Olympia and in Seattle as a cost-saving measure, with the Olympia School District facing an $18 million deficit over the next year and Seattle schools seeking to save approximately $30 million by closing two dozen elementary schools. Ending, reducing, or even temporarily sunsetting the gargantuan data center corporate tax break could be the basis for a statewide emergency education relief fund that could prevent school closures–the deferment amounted to $117 million in lost revenue in 2023.

At the same time, school consolidation happens in Washington because of declining enrollment, which determines the amount of funds a district receives from the state. Consequently, state lawmakers must create a long-term revenue source before state funding continues to decrease due to tanking enrollment and inflation.

Some have banked hopes for a long-term revenue solution on the achievement of a Democratic supermajority in the Washington State Legislature in the 2024 election cycle, which would give Dems the numbers needed to tweak the state constitution to allow more forms of taxes on wealth. A constellation of advocates and progressive lawmakers have also been fighting for a wealth tax, which could supplement the capital gains tax the Legislature passed in 2021. The point is, absent a commitment from Democrats to pursue economic justice in Olympia via taxes on the ultra-wealthy, no long-term funding fix will ever happen for education.

The Workforce Education Act, championed by former 43rd Legislative District Representative Frank Chopp, is a sterling example of what can happen when legislators use resources from the 1% to fund institutions we all use. Passed in 2019 via a business and occupation surcharge tax, the Workforce Education Act made college free for thousands of Washingtonians from households making less than $78,500 annually, expanded trade programs in state community colleges, and funded salary increases for school support staff. An expansion of the Workforce Education Act would mean free college for thousands more working class Washingtonians. These funds would also continue to support the state community college program Washington created in 1967, which stakeholders in the Washington State Labor Council see as a petri dish for worker retraining to build climate sustainability programs.

It's been said that “Seattle is a major league city with minor league leadership.” Nowhere is the statement more applicable than in public schools. When an austerity mindset is permitted to guide public policy-making, then parents, students, and teachers alike suffer.

Because of an approaching fiscal cliff of inflation, declining enrollment, and low birthrates that will further tank school resources, the clock is running short on time for state lawmakers to find solutions. Luckily, the State Legislature has usable examples in its own past.

“I would make it impossible for the avaricious to utterly impoverish the poor,” said Governor John Rogers Rankin, father of Washington’s first ever public school funding bill: “The rich can take care of themselves.”

Shaun Scott is a candidate for Washington State Representative in the 43rd Legislative District (Position 2). He is endorsed by Speaker Emeritus Frank Chopp, current 43rd LD Position 1 Rep Nicole Macri, and the Washington chapter of the American Federation of Teachers. His campaign website is BetterWashington.org.