This article originally appeared in the South Seattle Emerald.

If you are reading this article about school funding policy because you are mad about school closures, then you are moving toward becoming an advocate for fully and equitably funding schools.

In this 15-part series, we will occasionally venture into the often complicated details of how our schools are funded. Each article that will examine school funding in this mini-series will be written in partnership with educators, parents, and policy wonks with the goal of making complex issues accessible. We encourage you to reach out to us on X @Back2SchoolSEA with questions, feedback, or trolling.

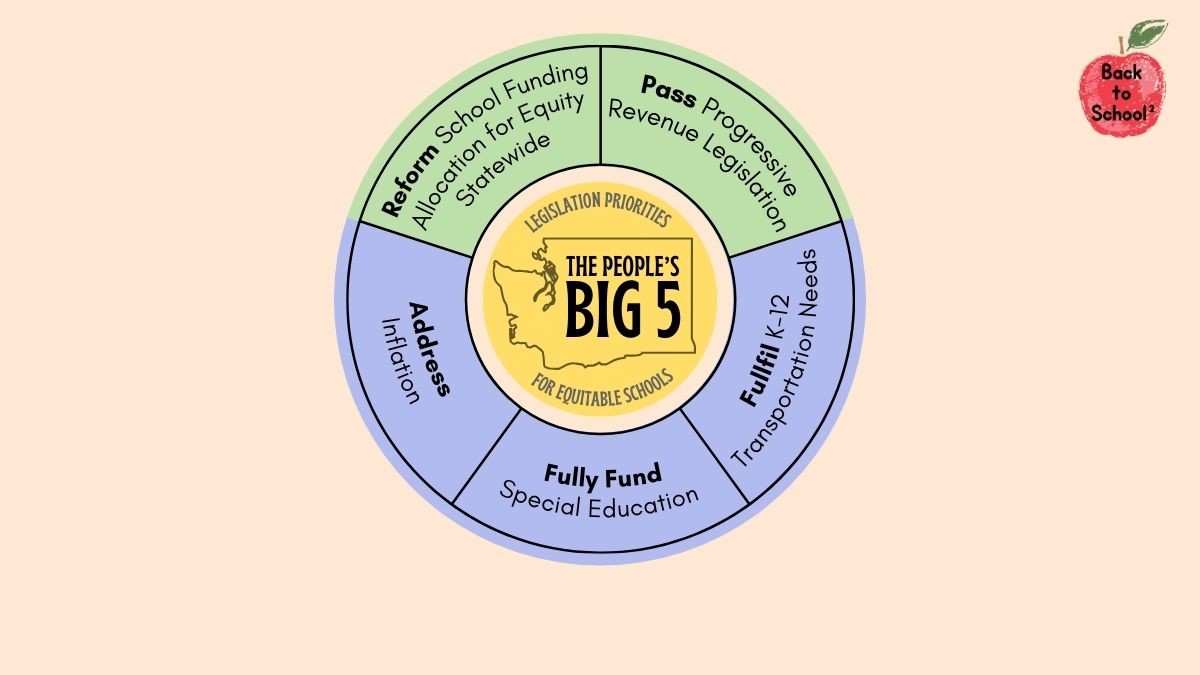

In order to understand why you should sign onto The People’s Big 5 Legislative Priorities to Fully Fund our Schools Campaign, it is important to examine the root causes of the fiscal crisis facing Washington state K-12 schools this year.

Our goal with this mini-series is to provide a “People’s Guide” as a companion to the state’s “Citizen’s Guide to Washington State K-12 Finance,” a useful but somewhat intimidating guide produced by the Legislature’s staff based on an even more intimidating report by the Office of Superintendent of Public Instruction (OSPI).

Understanding School Finance

To understand K-12 school finance, you must understand two key terms: revenue and allocation. Revenue is money collected through taxes, some of which goes toward the education budget, which is then spent (or allocated) by local school districts to run our schools and pay our educators.

Currently, we have a local and state budget crisis because the revenue that’s collected doesn’t meet the needs of what is spent. It doesn’t help that federal dollars on education risk being further cut. Equity becomes a second priority to addressing deficits.

We cannot talk about equitable allocation of funds if the pie we’re slicing up doesn’t represent the true wealth of our great state. Our current revenue system (that is, the tax code) depends on state and local property taxes and sales taxes, resulting in inequitable funding among school districts depending on whether they have high or low property values and income levels. In short, the pie we take from to feed education comes not from the wealthy but from the working class.

Many education advocates fighting for school funding again want to increase property taxes locally through a process they call a “levy lift.” Unfortunately, while that process benefits some school districts such as Seattle and Mercer Island, it burdens low-income residents with higher taxes and results in further inequity across the state. Many, including University of Washington (UW) education professor David Knight, point to changes the Legislature made in 2017-18 in what is called the “McCleary Fix” as a failed effort to make our school funding system more equitable.

As we explained in an earlier Back to School Series piece, there is a program designed to redistribute funds to districts with low property values that lack local revenue: It’s called Local Effort Assistance (LEA). LEA spending only makes up about 3 to 4 percent of our total education spending, and it doesn’t achieve equality among school districts, let alone equity, according to UW Professor David Knight. Calls for increasing LEA and Learning Assistance Program (LAP) are central to the Big 5, but these are seen as Band-Aids for a broken system.

Have You Heard of Regressive Prototypical Allocation?

The other part of the problem is allocation. The allocation model our state uses, which is called the prototypical model, does not meet our local or student needs. As it turns out, district costs do not match up with allocations in the prototypical model, and that is one reason we have a statewide budget shortfall for education this year.

The prototypical model funds districts based on the three standardized school sizes: 600 students for high schools, 442 students for middle schools, and 400 students for elementary schools. To try to remedy the inadequate prototypical model, the State Legislature has implemented regionalization factors that increase support for districts with higher costs. When a district breaks from the prototypical model in terms of school size, it usually starts to cost more money. In that case, the district’s only option is to pass local levies as “enrichment,” but there is a local limit as to how much districts can raise via levies.

Shaun Scott, a candidate for State Representative in the 43rd Legislative District (one of Seattle’s own districts) has signed onto the Big 5 campaign and published an op-ed in The Stranger unearthing the problematic history of not only our prototypical model but also the roots of settler colonialism in our education system.

The question now is which legislators will join Scott, Prof. Knight, and a growing number of rank-and-file educators across the state in signing the Big 5 Pledge.

The allocation formula can only be equitable if it comes from equitable revenue. This means we must pass progressive revenue, taxing the rich so that the pie we have to spend from represents the great wealth of Washingtonians.

A Crash Course on Regressive Revenue

Washington’s tax code, which dictates how our revenue is generated, is decided by the State Legislature and framed by our state constitution. Our system regressively draws on sales and property taxes, and research shows this tax code has a disproportionate impact on the poor and working class. This regressive system was decided by five men on the State Supreme Court in 1933.

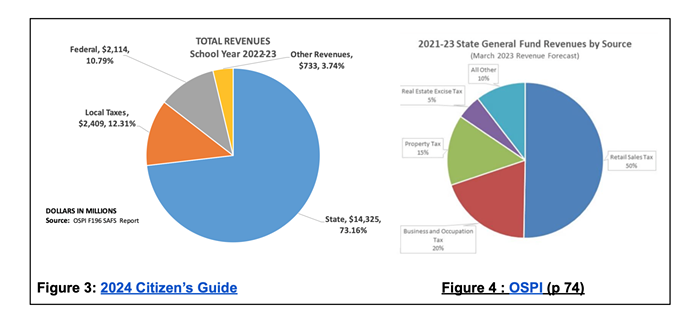

Our local and state taxes make up 85% of our school funding. As Figures 3 and 4 below show, local taxes come directly from property tax levies, while state taxes come from a combination of property taxes, business taxes, and the sales tax, which constitutes most of the pie. The federal funds, which make up 10% of the budget, are mostly directed toward costs for Title I, special education, and unreliable emergency funds like COVID relief dollars.

Some analysts wrongly focus on measuring equity in K-12 spending by using the percent of our budget, aiming for total education spending to make up 50% of our state’s budget (we are currently at 43%). These measurements fail to recognize cost fluctuation between states and inappropriately pit education against other important social services.

Instead, we suggest considering Washington’s national ranking for our K-12 education spending as a percent of state income (GDP). According to Professor Knight, Washington spends about 3% of GDP on education, while the national average is closer to 4%. While some advocates are calling for $2 billion more in education funding, an extra 1% of our state GDP would mean a much-needed $20 billion in more spending for K-12 education per biennium. OSPI Superintendent Chris Reykdal released his plan for the Legislature this week, asking for a $3 billion yearly increase to our state’s K-12 budget. Getting to 4% is one goalpost for equity in the coming years, but that would take $10 billion more in funds for K-12 education, annually. To get there, we will need new progressive revenue.

There is genuine merit to blaming the federal government for our funding woes, since they have yet to fully fund special education as directed by the Individuals with Disabilities Education Act (IDEA) of 1975. But it is the State’s "paramount duty" to amply fund our schools, so advocacy efforts have coalesced in Olympia.

Since the 1920s, Washingtonians have fought for a progressive income tax at the state level, but, finding little luck there, advocates have focused on pushing for increases to local levies for their own schools. The reluctance of the State Legislature to pass progressive revenue pits local districts against one another, as this report from University of Washington shows us.

Reversing Systemic Inequities and “Equity” Half-Measures

The People’s Big 5 Priorities calls for new progressive revenue policies now. One proposal includes replacing regressive taxes, such as sales and property taxes, with a progressive income tax, a wealth tax, expanded capital gains taxes, or, more realistically, a combination of multiple policies. But legislators and progressive advocates are waiting to see the results of several billionaire-backed November ballot initiatives before making any announcements on new legislation.

In sum: Our revenue system has a twofold inequity: 1) Revenue sources cause a disproportionate burden on the poor and working class; and 2) Local taxes raise less money for higher-poverty, lower-home-value districts.

The Big 5 would help flatten this regressive curve seen in both graphs in Figure 5 below by shifting revenue to progressive sources and away from regressive sales and property tax. Expanding programs such as LEA and LAP would be the first step, with larger reforms to the prototypical model to come, with a solution informed by experts like Knight, but also districts, students, and labor unions.

In Washington State, school funding got so bad in 2012 that our Supreme Court ruled our Legislature’s school funding plan unconstitutional in the now infamous McCleary ruling. The supposed “McCleary Fix” from 2018, which Knight has challenged over and over, limited local enrichment levies that rich school districts depend on while expanding state property taxes in a deal known as a “levy swap.”

This “equity” measure did increase taxes in cities and distribute the funds statewide, but it also had a devastating impact on lower-income, lower-property-value cities in King County with higher populations of color like the cities listed in Figure 5. Many well-meaning advocates for education and lawmakers in cities such as Mercer Island, Bellevue, and Seattle might feel inclined to try to lift local levy lids to pay for their needs, expanding already bloated and regressive property taxes. Instead of continuing to displace communities of color in the name of so-called equity, we only need 4% more of our state’s pie. To access that wealth, we need progressive revenue.

If you want to join the 100-plus year People’s fight to tax the rich in Washington and call on our legislators to put progressive language into action, then join the People’s Big 5 Campaign to fully fund our schools by taking three easy steps:

- Sign the pledge: bit.ly/fullyfundwaschools

- Email your legislators: https://actionnetwork.org/letters/tell-state-representatives-pledge-to-support-the-big-5-legislative-priorities-to-fully-fund-our-schools-by-taxing-the-rich-statewide?source=direct_link&

- Check out our new website: https://www.thepeoplesbig5.com/

Education Finance 102 will come out in October and follow up on this article. It will focus on local issues in the Seattle School District and look at how the State’s prototypical model fails to meet the needs of our students.

Now, for a little fun, please complete the following pop quiz! Ohhh no! Boo, quizzes!

Pop Quiz: Do You Know Your Education Finance?

1. True or False: The Washington State Constitution uniquely declares: “It is the paramount duty of the state to make ample provision for the education of all children residing within its borders, without distinction or preference on account of race, color, caste, or sex.”

True

False

2. True or False: According to the ITEP Tax Inequality Index, Washington has the second-most regressive tax code in the country, behind Florida. Based upon Figs. 1 and 2 below, it is accurate to say our state’s tax system burdens the poor and working class disproportionately while billionaires get away with paying a lower share of their income on taxes.

True

False

3. Which of the following is part of the “People’s Big 5” Legislative Priorities to fully fund our schools? (Select one.)

a. Fully fund Special Education

b. Expand K-12 Transportation

c. Address Inflation

d. Reform School Funding Formula for Equity (LEA, LAP, Prototypical Model)

e. Pass Progressive Revenue Legislation (Wealth Tax, Capital Gains, Income Tax)

f. All of the Above

4. When did the fight to pass progressive tax begin in Washington State?

a. 2024

b. 1890s

c. 1920s

BONUS QUESTION #1: Depending on the outcome of the upcoming election, the federal government will cut how much proposed funding to education:

a. 5% percent

b. 14% percent of overall funding

c. 25% percent of Title I funding

d. b and c

BONUS QUESTION #2: How much special education funding did the federal government promise to provide when they initially passed the Individuals with Disabilities Education (IDEA) Act? What do they actually provide?

a. 10% promised, 5% provided.

b. 40% promised, 13% provided

Answer Key: True, True, f, c, d, b

Don’t worry if you failed. The quiz isn’t graded. ;)

This article is part of a series in the South Seattle Emerald called Back to School2: An Educational Series on Education highlighting advocacy efforts in education policy from the local School Board to the State Legislature. It is co-produced by Oliver Miska.

Oliver Treanor Miska, 33, is a queer Seattleite, educator, community organizer, and lobbyist for educational justice policy in Washington State. Moving out of full-time classroom teaching after six years, they substitute teach in SPS and are founding director of Solidarity Policy and Public Affairs, a political consulting firm. As a community organizer, Oliver has held leadership roles within Seattle Democratic Socialist of America and Washington Ethnic Studies Now, where they co-lead a statewide legislative coalition. Oliver is also a member of SCORE, the Seattle Caucus of Rank and File Educators of Seattle Education Association (SEA), our educators union. They work to organize youth, families, educators, and community organizations to pass progressive revenue to fully fund our schools statewide. To contact them, email: solidaritypolicywa@gmail.com

Jeff Paul, 31, is a special education paraprofessional who has been serving students in Seattle Public Schools for six years. They are a member of the Seattle Caucus of Rank-and-file Educators, a progressive caucus within the Seattle Education Association. Jeff is actively involved in Seattle's growing labor movement, serving as a member-at-large on the SEA Paraprofessional Board, as well as a delegate from SEA to the MLK Labor Council. They are a trustee on the executive board of the Young Emerging Labor Leaders and a founding board member of House Our Neighbors, a housing advocacy organization in Seattle that fights for social housing, climate action and connected communities.