One would expect that the 3,700 millionaires Seattle added in 2023 alone would mean the city as a whole (meaning, the public spirit of the area) would be that much richer. But such is not the case. Indeed, it appears to be the opposite. The Seattle City Council now claims to be broke, the same goes for Seattle Public Library and Seattle Public Schools. And so, the addition of, as Puget Sound Business Journal worded it, "3,700 newly minted millionaires, nine centimillionaires and one billionaire in 2023" is not at all a blessing. Indeed, it's not a stretch to connect this explosion of the richest of the rich with the new and deeply regressive composition of the City Council. Is this a law that needs our attention? One that has, like so much in economics that's related to reality or facts, been ignored? Concomitant with a rise in W is a decline in P? (W being the number of wealthy people and P representing public wealth.) What kind of city or urbanism can we expect with the hardening of this law?

Before we examine the urbanism that's adequate for those who have fewer infinities than most (more about this infinities business in a moment), let's be clear about what makes a millionaire a millionaire. The less confusion on this matter the better.

Puget Sound Business Journal writes:

The number of millionaires in Seattle grew 72% between 2013 to 2023 to a current estimate of 54,200. The city is now also home to 130 centimillionaires and 11 billionaires. The report [by the global wealth management firm Henley & Partners] defines “millionaires,” “centimillionaires” and “billionaires” as individuals with over $1 million, $100 million and $1 billion in liquid investable wealth, respectively.

Liquid means cash-in-hand or assets that can easily be converted into cash. A millionaire, in this sense, has a million that can generate income from the dividends, interest rates, or manipulation (buybacks) of financial assets. A middle-class homeowner does not fit this description. For one, a member of this group usually doesn't outright own the key middle-class asset, a house. It's owned, instead, by a bank. The"homeowner" can, of course, use the asset as collateral for a loan or claim its equity when it's sold. Both forms of capital extraction depend on the state of the housing market specifically and the economy as a whole.

What about the poor? What makes a person poor? It is a high number of infinities. A rich person, by contrast, has few or close to no infinities, this is why billionaires turn to space, to the stars, to rockets, to visions of occupying Mars. There are just too few infinities for them on Earth. But a poor person is confronted with an infinity when, say, the "average rent for [a 1-bedroom] apartment in Seattle is $2,227." Why infinity? Because the average rent is so high that it's as obtainable as any price above it, be it a million/billion/trillion bucks. A key component of American ideology is to disguise these real and hard infinities by celebrating the self-made rich, emphasizing individualism, and pushing self-help solutions.

One more definition is in order. It concerns the economic category of late capitalism. It is used a little too loosely these days. For example, a class offered by the Brooklyn Institute for Social Research describes the current stage of capitalism as late:

[L]ate capitalism without citing baneful examples of its spatial manifestations—the soullessness of Hudson Yards; the Grenfell Tower disaster; the (lethal to build) Qatari World Cup stadiums; aestheticized server farms and data centers.

But the world-systems theory correctly defines this category as the final stage reached by a nation that holds the dominant position in a globalized capitalist order. The Dutch moment, for example, experienced the late stage in the early 1700s. Great Britain entered it at the end of the 19th century. The US, in the 1980s. What characterizes late in all of these moments is the transition from a productive (real) economy to a financialized one. China is still in the productive stage of capitalism, but it will eventually sunset with the expansion and final dominance of its financial sector.

With all of this in mind, let's turn to what I call billionaire urbanism, which is specific to late-stage American capitalism. To grasp the substance of this specificity one has to apply the Uno School's description of a totality, which is the completion of an economy's "inner logic" (read Uno Kozo's Principles of Political Economy: Theory of a Purely Capitalist Society). In this respect, American capitalism was structured by a housing market that rapidly expanded after the Second World War. A feature of this expansion was gentrification, which the German-British urban sociologist Ruth Glass first identified and named in 1964. As I explained in another post, gentrification is an innovation of what's called the Golden Age of Capitalism (1947 to 1970). It entered hyperdrive after the deregulation of finance in the 1980s.

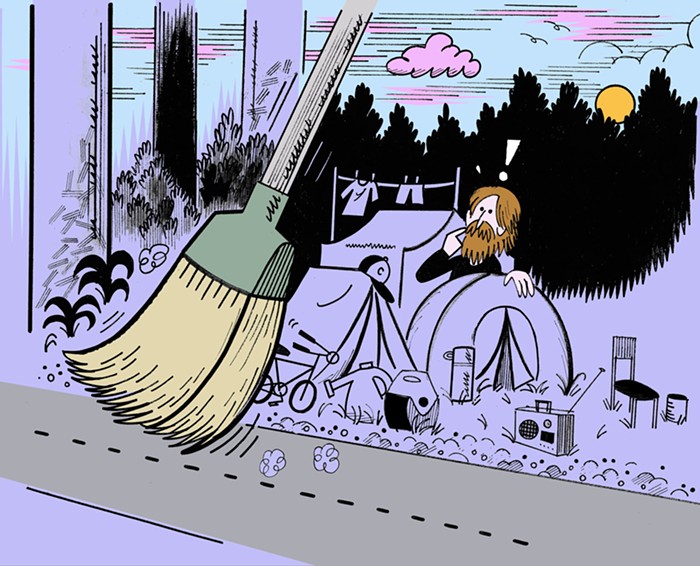

In Seattle, as with other cities, gentrification was totalized around the time of the housing crash of 2007. Indeed, the crash might be seen as a manifestation of this totality. The process simply ran out of gas, out of poor people to displace, out of NINJA loans to securitize. What was next? Billionaire urbanism. This kind of spatial configuration expresses the command those at the top have over all revenue. Investing in the classes below billionaires, centimillionaires, and millionaires is no longer meaningfully profitable for those with "liquid investable wealth." The returns on capital directed to commoners (the infinity people) are way too small or too slow. This is why Seattle's Council is seriously considering cutting investments to the lower classes. This isn't an accident. Something that's out of the blue. It's consistent with the new structuring (and spatial) logic of billionaire urbanism. All post-gentrification investments must (can only) go to the very top because that's where all of the money is locked. Like likes like.

The solution to the decline of Seattle's downtown will not be social (long-term) investment but the phantasmagoria of its own Hudson Yards.