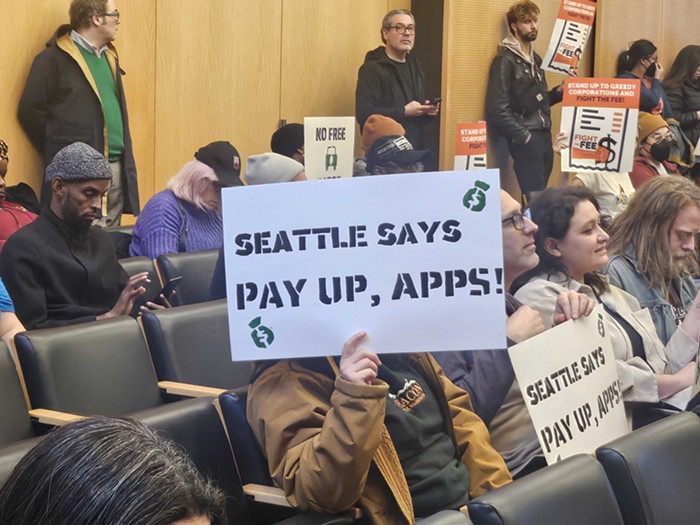

If you are following Hannah Krieg, you will recognize the return of a regressive and debunked reading about wages: When high, they are bad for business and even workers. With this logic, which makes no economic sense, we find Bruce Harrell repressing the wages of city workers, Council Member Maritza Rivera blaming Seattle Public Library's closures on, of all things, union wages. And Chair Sara Nelson’s dramatic (if not fanatical) devotion to reducing gig workers to paupers. And just like that, we have a united front.

So this is what Seattle voted for between 2021 and 2022. This is what progressives didn't have the guts to do? End the homeless crisis and crime with not only sweeps but also low and stagnant wages. It's like that old Toyota jingle: "You asked for it, you got it..." And, mind you, we are still in a period of economic expansion (one doesn't want to imagine how low Sara Nelson would go during a period of contraction). But this is the question we must now ask: Why are low wages generally bad for the economy?

I thought that Seattle's new conservative council would take a minute before going full-on corporate stooge. Maybe start with some police legislation, some new drug laws, some homeless bans—you know, the fearmongery stuff that got them elected. But no... https://t.co/pAHq8MLwuN

— Rich Smith (@richsssmith) April 25, 2024

Let's put aside the fact that Council Member Maritza Rivera is an out-and-out Republican, the anti-union party, and consider the real economic consequences of low wages. High turnover, poor performance, and the transference of private costs to social costs. In short, inefficiency for profits that are, at best, ephemeral. In 1957, the Ukrainian-American economist Harvey Leibenstein introduced the concept of efficiency wages. It was first applied to developing countries but, in the 1970s and 1980s, was adopted for developing ones as well. Indeed, the neo-Keyensian (not to be confused with post-Keynesians—the former is center left; the latter, totally on the left) Carl Shapiro and Joseph Stiglitz even developed a mathematical formula for efficiency wages called Shapiro–Stiglitz theory.

What are efficiency wages? The London School of Economics offers this simple description:

Main feature in efficiency wages: firms unilaterally set wages, and choose not to cut wages down to the market-clearing level, because of the detrimental effect that this would have on worker effort, motivation, recruitment, retention, and ultimately on firm profits.

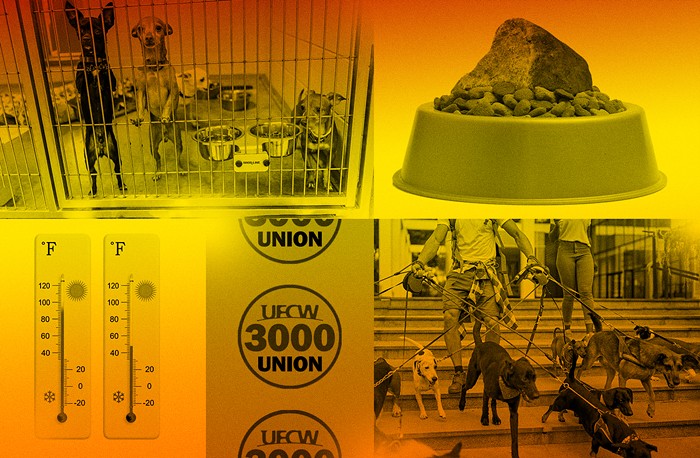

This, of course, is Nick Hanauer's position. So, this isn't something that's way out there and radical. High wages reduce waste, improve the lives and health of workers, and result in better products and services. So, if Seattle fulfills Chair Sara Nelson's dream of impoverishing gig workers, it would likely worsen the homeless crisis (the social cost) and certainly result in still-expensive shitty rides and deliveries.

That's the economics. Let's now turn to a question that's conveniently ignored by local business associations and their puppets in City Hall: Why is the cost of living in Seattle so high? The main reason is found in housing. An example: The majority of Seattle renters experienced sharp increases in rent "in the past 12 months." Is City Hall looking into this? You wish. Wages are the only game in town. But imagine if we had a mayor or City Council President who cares about the real stuff. What would they find? Likely what More Perfect Union found when it examined the housing markets in Phoenix and Washington D.C.: a price-fixing company called RealPage.

RealPage is a website that lures landlords with the promise of super-profits. The company does this by, one, using confidential information, and, two, running an algorithm that "[keeps] the overall market at its highest peak." The algorithm does not care if the increases leave an apartment building with a lot of vacancies because the rent inflation is enough to cover for the loss of occupants. This, in a word, is not a market (a myth) but a cartel, the heart and soul of capitalism.

It's hard to believe that the price manipulations orchestrated, and even policed, by RealPage are singular or exceptional or isolated. It's hard to believe that Seattle's rent increases are due sheerly to market forces. We are not that special.

As Gene Balk demonstrated in the post "Most Seattle-area renters report big rent hikes in the past 12 months," the recent rent hikes are pretty uniform. Meaning, no matter where you go in this city, you are bound to run into increases that seem to have no end in sight and, more importantly, are not checked by the kind of political opposition that wages so easily face. If the market was actually competitive, you would expect to see less homogeneity and more diversity in prices. Scratch the surface of any rental market and you are bound to find variations of RealPage.