You live in Seattle. You know the undoing of Boeing that began when its new and very popular 737 MAX, operated by Lion Air, plunged, not long after takeoff, into the Java Sea, killing all passengers and crew. Five months later, another 737 MAX fell out of the sky, this one operated by Ethiopia Airlines. Its passengers and crew met the same fate as those on Lion Air. But this time the crash was an explosion of earth rather than water.

A new documentary, Downfall: The Case Against Boeing, directed by Rory Kennedy (and, yes, she is a Kennedy—the youngest daughter of Robert F. Kennedy), begins with the story of the first crash. It features journalists, industry experts, and an Indonesian woman whose husband was a pilot on Lion Air Flight 610. It also examines Boeing's response to the crash—blame the pilots for not being American. The doc then covers the second crash in Kenya. This story features an American man whose daughter's life came to an end on Ethiopian Airlines Flight 302, footage of American pilots who defended the safety record of Ethiopian Airlines, and Boeing's PR push to, once again, blame the crash on non-white pilots. They were not American enough. They were black. They came from a poor country.

This excuse might have worked well enough in the USA, but not in China. That government saw what was what and grounded the 737 MAX. As Boeing gassed up America with shameless racism, the rest of the world followed the leading capitalist power of the 21st century, the Chinese Communist Party. Eventually, all 737 MAX were pulled out of the sky and the US's press and government began searching for answers in the right place, Chicago.

But the fact it was China that made the call to ground the American-made planes is the most important revelation in this documentary. It tells you almost everything you need to know about the present state of the US, which, as the theorists of the world-systems school have pointed out since the 1990s, is in a period that's described as autumnal and is characterized by the rise and domination of finance. The UK entered the fall of finance after the Great Depression of 1873. The United Provinces' 30-year autumn concluded with the Fourth Anglo-Dutch War. China will have its autumn as well.

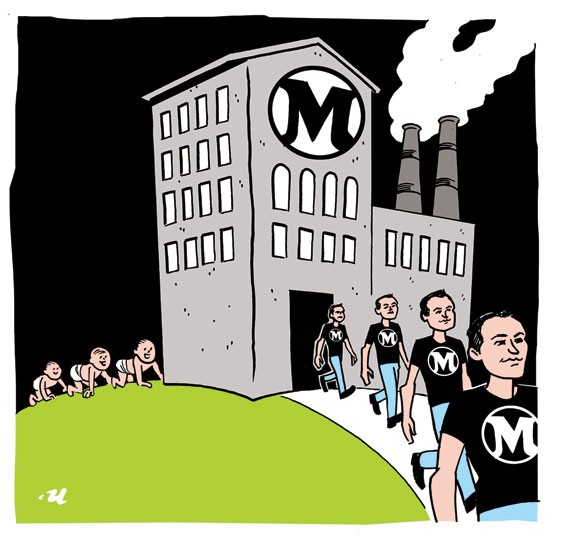

The documentary, which is certainly engaging, does describe Boeing's transition from a company centered by engineers to one centered by shareholders. And it makes one mention of the company's buyback bonanza, which continued even after the Lion Air crash. The same cannot be said about the Seattle Times, which made no mention of Boeing's decade-long reallocation of accumulated capital from production to the inflation of its value on the stock market. I was the only writer in Seattle's press to make a lot of noise about it, and so was not surprised, as Seattle Times' business writers were, when its planes started falling out of the sky.

Peter Robison's 2021 book Flying Blind: The 737 MAX Tragedy and the Fall of Boeing does devote several pages to Boeing's buybacks and superbly explains this form of legalized market manipulation.

Robison writes:

Rather than investing in new aircraft, Boeing’s leaders poured more than $30 billion of cash into stock buybacks during the MAX’s development, enriching shareholders and ultimately themselves.... Buybacks of the sort Stonecipher had instigated were once considered market manipulation. They represent a technique in which a company uses its revenue to acquire its own shares on the open market, then cancels them. With fewer shares outstanding, the ones left are more valuable. Hold a single share in a company that issued one hundred shares and you own a 1 percent stake. If the company buys back half of the existing shares, you now own 2 percent, artificially increasing the value of your share and increasing your dividends, without any additional expenditure on your part.

The question you must ask at this point is: Why was I right and the Seattle Times, despite its considerable resources, so in dark? The answer is simple. I'm a Marxist, which means, I see capitalism as a system that's not only historically specific but has features that are cultural rather than natural.

To give one example among many. Downfall's description of Boeing's move from a culture of engineers to one of shareholder maximization takes the predictable path of the bad apple. This particular company had a merger, and its headquarters moved from Seattle to Chicago. It abandoned its commitment to the kind of safety that made the Jumbo Jet one of humankind's top engineering achievements. And so on. But this reading of the downfall is too myopic. We need to do like a Marxist and see the big picture.

In the 1970s, the US as a whole went through a corporate culture shift that cut the close relationship between managers and workers that developed after World War 2, and instigated a capitalist boom the likes of which the world had never experienced, and, instead, tied managers to speculators (also euphemistically called investors). You can read about this transition in The Crisis of Neoliberalism by the French Marxist economists Gérard Duménil and Dominique Lévy. The story of Boeing's fall is also the story of the US's fall.

If you miss Sundance's screenings of Downfall: The Case Against Boeing, it will be available on Netflix on February 18.